Student loan forgiveness applications are now open for students

Students can apply for federal student loan forgiveness now.

U.S. President Joe Biden announced on Monday, Oct. 17 that applications for his administration’s student loan forgiveness program are now open.

Paula Elenbaas, associate director of financial aid at Calvin, told Chimes that on average 56% of domestic students leave Calvin with about $25,000 in student debt.

According to financial counselor Beth Miller, this is lower than other private schools, where students graduate with an average $31,000 dollars in debt. However, debt can still be a weight that Calvin students carry post-graduation.

The $10,000 plan forgiveness offered through the program is a significant chunk of an average Calvin student’s debt. “About the average student loan debt coming out of Calvin is about $25,000, so if they can reduce that by $10,000; That’s amazing,” said Elenbaas.

Biden made a promise regarding student debt relief during his 2020 campaign; now it is coming to fruition.

However, there are income guidelines used to determine relief; if it’s a single parent, $125,000 or less. If they’re filing married, jointly $250,000 or less; that’s based on 2020 or 2021,” said Elenbaas.

The deadline to apply for loan forgiveness is Dec. 31, 2023, but, according to Elenbaas, students are encouraged to apply sooner rather than later.

“Things could change … right now the process is on hold, there was a lawsuit that Federal Court of Appeals in St. Louis said we need to look into this. Students can still apply, but nothing is going to be processed right now,” said Elenbaas.

Both Elenbaas and Miller commented on how easy the application was.

“It’s very simple, which is not what we expect from federal government applications,” said Elenbaas.

“This is probably the simplest application I’ve seen,” said Miller.

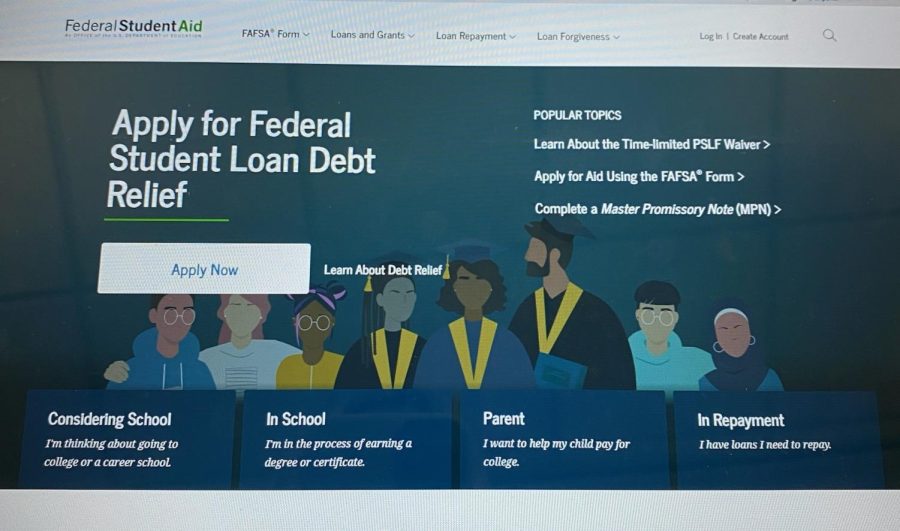

According to Elenbaas, students can go to studentaid.gov and click “apply now” on the home page. The only essential information students need to fill out is their name, address, email, phone number and social security number.

“Those are the five things they have to enter –– that’s it,” said Elenbaas.

Elenbaas said this could help lower students’ stress levels about debt and make it more manageable.

“If it’s available, we definitely encourage students to go for it,” said Elenbaas.