Students ride GameStop roller coaster

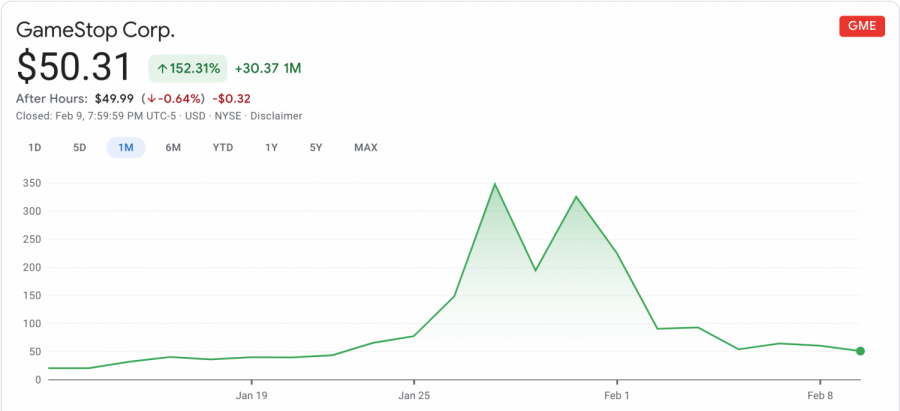

Screenshot from Apple Stocks app.

GameStop stock rose abruptly in the end of January, but has sunk again since.

When Reddit-fueled retail investment in GameStop took the stock market for a wild ride in January, a few Calvin students joined in the fun.

“It was like FOMO,” said Darian Seale, senior civil and environmental engineering major, “I saw the bandwagon and I was ready to jump on it.”

According to CNN Business, GameStop’s stock began to rise on Jan. 11 after the company introduced a new director to the board who offered hope that the brick and mortar video game store could move in a digital direction. As this idea gained traction on a Reddit forum called WallStreetBets, the price of the stock shot up, sending hedge funds who had shorted GameStop stock into a panic.

Seale, who learned about the GameStop surge on WallStreetBets, said the influx in investment represents a movement.

“Essentially it’s the small guys sticking it to the ‘man,’” Seale said, characterizing the Reddit-using retail investors as David and the hedge funds who shorted GameStop stock as Goliath.

Seale’s housemate Benjamin Duimstra, a senior electrical engineering major, also has stock in GameStop and has participated in the Knights Investment Management club at Calvin

“The everyday person, the middle class person, or whoever, isn’t able to participate the same way these multi-billion dollar companies are,” Duimstra said, noting how brokerage app Robinhood restricted the trading of GameStop stock temporarily in response to the rise in investments. “Everybody should have the right to purchase a stock whenever.”

Both students acknowledged that the Reddit-grown movement may have helpful information, but it isn’t the place to go for airtight financial advice.

“It’s called WallStreetBets, not ‘How to Make Money Off the Stock Market’,” Duimstra said “‘Bets’ implies some sort of gambling.”

Seale said that he, like many on the subreddit, would not claim to be an expert.

Yet retail investors managed to create a flurry on the stock market that has only begun to settle down. According to Calvin business professor Dirk J. Pruis, not every aspect of the situation has been well understood.

“There are some people who have the view that having the ability to short stock is a bad thing,” Pruis said. “Generally, it’s a very good thing for a market to have the ability to take a position either direction, either thinking a stock is going up or going down.”

Pruis also noted that some of the online communication about GameStop could be considered market manipulation under laws enforced by the U.S. Securities and Exchange Commission.

“Getting people interested in the market is a good thing,” Pruis said, though he hopes this doesn’t lead more people to gamble in the stock market by investing in something they don’t understand or haven’t taken the time to study. He also expressed concern about the gamified nature of platforms like Robinhood, which has received a good amount of media attention over the past month.

Seale and Duimstra are both still holding on to their GameStop stocks. They plan to invest more conservatively in the future, but this time around, it was more about the movement and the learning experience.

“If the goal of this was to make money, everybody would have cashed out when it peaked at 500 bucks,” Seale said, arguing that holding on to the stock is a way to stand up to a system that he sees as “kind of corrupt, kind of broken.”

According to Seale, the atmosphere on WallStreetBets is less ecstatic than at the height of the GameStop surge, and the usual memes are interspersed with admissions of defeat. There is a divide between those called “paper hands” on the forum, who are solely in it for the money, and “diamond hands,” who are still holding their stocks in solidarity with others.

“The stock market is a source of opportunity,” Seale said, “But it’s also a source of turmoil.”

That’s certainly true for the hedge funds and retail investors alike who experienced the market’s danger and potential over the past month or so, wrangling over a prize as unlikely as GameStop.