Decreasing student debt despite increasing tuition

Because of a recent increase in funding for donor scholarships, the average debt of Calvin graduates decreased in the past year by approximately $3000 per indebted student. Jodi Cole-Muyskens, director of development, stated that in the past year, $5.8 million was raised to fund donor scholarships for the 2019-20 school year. Cole-Muyskens called this number exceptional compared to an average of $4.3 million per year over the past decade.

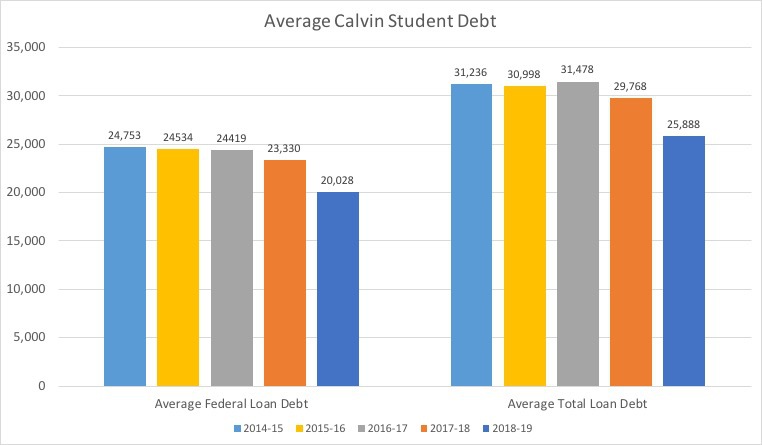

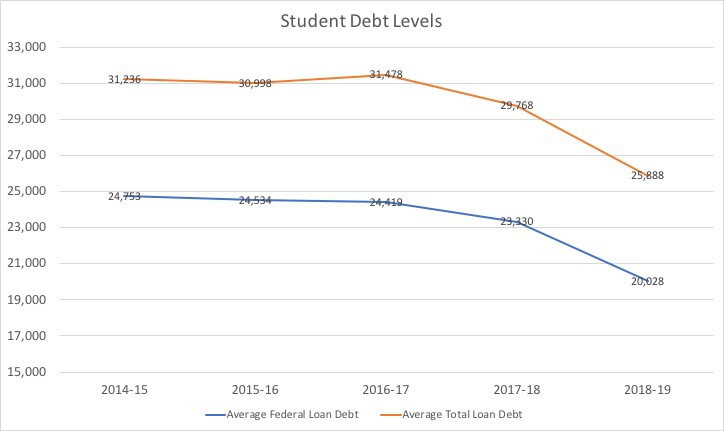

A graph of student debt.

Increases in scholarship funding are believed to be the result of increases in the cost of tuition. Donors hope to give Calvin students an affordable education, and the rising cost of education has led them to give more support. Although it is unsure if this level of donor support will continue in years to come, Paul Witte, director of financial aid, hopes that student debt levels will maintain their current state despite still-rising tuition costs.

The number of Calvin students graduating with debt decreased from 60% in 2018 to 55% of 2019 graduates. Of these students, the average student loan debt shrunk from $29,768 in 2018 to projected figures near $25,888 for graduates in 2019. This information comes from the university’s common data set, a data report summarizing institutional information, which is nearing finalization for 2019 graduate data. Data is reported on students who attended Calvin for all four years of undergrad. Cole-Muyskens stated that in the current academic year, 1,120 students received 1,360 unique named scholarships, totaling $3.9 million of financial aid.

Despite the amount of debt students leave Calvin with, only 2.4% of students with loans default on those loans. Compared to a national average of 10.1%, Witte expressed that this difference portrays the difference in quality of education and the jobs Calvin students secure upon graduation, saying, “though we don’t like to promote student debt, for Calvin students that need debt, they’re getting careers that [allow them to] stay current with their student loan payments. So you’re getting value out of your education at Calvin.”

Donor funding is handled by gift officers in the development department. These officers work to raise support, determine the intent of donors, and ensure the proper allocation of donor funds. Identifying the passion and goals of donors allows gift officers to develop specific scholarships. Cole-Muyskens says that approximately 20-25 new scholarships are added yearly to the already 725 named scholarships.

When a donor wants to create a scholarship, funds can either be set aside in an investment account that will generate the scholarship amount yearly in interest, or the donor can contribute to the scholarship annually. The development department hopes to bring in $3.5 million in funding each year.

In addition to donor scholarships, Witte stated that financial aid employees seek to connect students with outside scholarships. One way of doing so is through Calvin’s new partnership with Scholarship Universe, a search engine that uses personalized criteria to find the scholarships best suited to an individual applicant.

Witte also explained that federal loans and U.S.-based lenders are difficult if not impossible to access for international students. Often, international students rely on funding from family members or foreign lenders, making data collection for the debt of international students difficult.

In the face of increasing costs, Calvin students will continue to rely on donor-funded scholarships to reduce student debt for years to come. While recent numbers are the lowest they’ve been in years, Witte stated that it will take continued support to maintain these lowered levels of student debt.